When retailers like Target get hacked and lose million and millions of customers' data, they usually apologize and offer a year or so of credit monitoring services to make amends. With Neiman Marcus, Michaels andHome Depot also struggling with data breaches, there's no reason to wait for them to throw you a bone. Here's how you can monitor your own credit, for free, for as long as you want.

Credit monitoring services keep an eye on your credit report and alert you to any significant changes or suspicious activity on any of your accounts that could influence your credit score. It's not the same as transaction monitoring or fraud alerts, but it's great at catching identity theft, as long as it happens while your accounts are being monitored. If someone opens a new account in your name, or maxes out one of your credit cards before you notice it, a monitoring service can alert you and your banks to take the appropriate action.

Why Temporary, Company-Offered Credit Monitoring Sucks (but It's Better Than Nothing)

One of the big problems with taking retailers up on their credit monitoring offers is that sometimes they come with strings attached. They may ask you to give up your right to sue them and waive any liability they may have for losing your data if you take them up on it, forcing you into arbitration if you want to take action against them. None of the companies in the latest hacks have done that yet, but it only takes a trip down The Consumerist's arbitration tagpage to see how well that usually works out for consumers.

The bigger issue with retailer-offered credit monitoring is that it's temporary. Sometimes it lasts for a year, maybe two if you're lucky. Some of the smaller companies tap out at six months because they can't afford to pay one of the big credit bureaus what it costs to monitor customer credit for longer than that. Unfortunately, in any case, it's usually ineffective because the data thieves that took the information are often more interested in selling the data than using it themselves. Then, once the data is off of their hands and they've been paid, the groups buying the data will sit on it for a year, or a few months—however long it takes for the credit monitoring to expire—and then start duplicating cards and testing out bank and credit accounts.

While we're not saying you shouldn't take up a company or an organization on their free credit monitoring if it's offered, we are saying that the limitations are fairly obvious. Plus, there are ways to monitor your own account like a hawk without having to put more energy or effort into it than you probably already do. Let's take a look at some of them.

See (and Use) What Your Bank Has to Offer

If you're in the market for credit monitoring services, it's possible that your bank or card issuer may already offer it, and you don't need to go to a third party to get it, and you don't have to give your personal information to someone that doesn't already have it. If they don't offer it themselves, they may have a preferred partner or company that they work with, who's willing to offer perpetual credit monitoring services beyond what you'll get from a bare-bones retailer's offer.

Even if you're not looking for credit monitoring specifically, there are other ways to keep tabs on your account activity other than logging in and checking every day (which is worth doing too, if you really want to see it all). Most banks offer account alerts and notifications if certain transactions take place or conditions are met. For example, Wells Fargo can notify you if there's a transaction on any of your accounts for over a given dollar amount, if there are any internet or telephone transactions, and if your account hits a specific dollar amount. Capital One can notify you if you've made any international purchases, or if you make any purchases above a given dollar amount.

The beauty of these limits is that the purchase won't necessarily be blocked unless you tell the bank to do something about them—you can set them where you're comfortable, and use the emails or text messages you get as a way to monitor your account activity, and if you do see something suspicious, you'll know to alert your bank right away. Issuers are generally happy to give you tools to monitor your account even if you don't log in—after all, it comes in addition to their own fraud prevention efforts, and the best possible result is that they catch fraud sooner for less money spent on their part.

Track All of Your Transactions In One Place

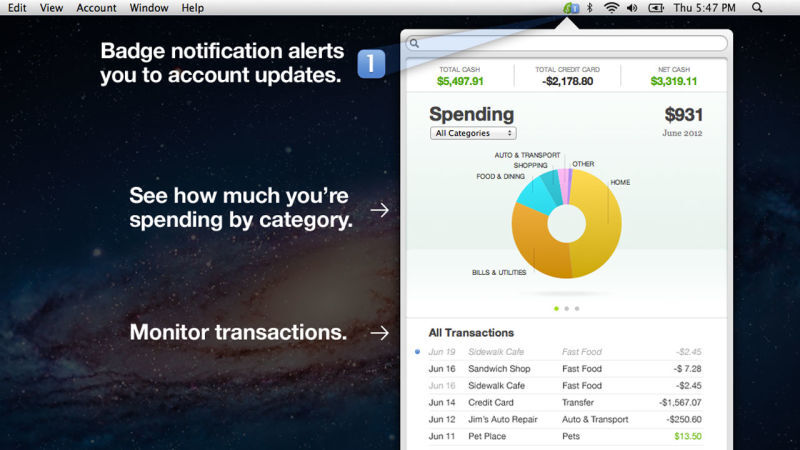

This one's a bit of a no-brainer, but it also works as part of a personal, always-on credit monitoring profile. Use a service like Mint, Your Need a Budget, BillGuard, or another online, always-updated personal finance tool that connects with your banks to track your transactions. This way, while you're waiting for your bank to send you anything out of the ordinary or your credit card company to call you if there's anything suspicious, you can always see all of your transactions without having to log in to each account individually every day and check.

We've mentioned before that grey charges can pop up anytime, and even look legitimate if you're not watching carefully. These tools let you filter by credit cards and bank accounts, see all of your transactions, filter based on ones you know and have been processed before, and flag down unknown transactions that could be someone testing your account to see if you're watching closely. Using an all-in-one tool, whether it's one that syncs with your banks actively, or a tool you sync manually and sift through when ready, is key to making heads or tails of everything going on with all of your accounts.

Finally, once you've take care of the previous two items, you can—and should—sign up for a credit monitoring service that's free and comes without strings or deadlines. Credit Sesame and Credit Karma are both services we've mentioned before, and who both offer tons of financial advice that's worth following both to their customers and for free on their respective blogs. Best of all, both services will monitor your credit for free, for as long as you have an account, with no strings attached.

Both services will offer you premium features for more information, like additional credit scores, real-time notifications, reports, and other financial tools, but at their core they're both designed to boost your financial literacy and help you protect your accounts and credit at the same time. In some cases, they'll also offer monthly credit scores, so you can monitor their changes and see how your spending or saving activity influences them, and they'll work with you to fix errors or issues with your credit report as well. Still, it's their credit monitoring and identity theft prevention features that are most important here, and since they're largely free (or freemium, at worst), they're worth signing up for.

Finally, it's important to manage your credit reputation. Make sure you get your regular, free credit report from AnnualCreditReport.com, and aggressively fix errors that may be on it, even if you have to enlist the help of one of these companies to help you do it Everyone in the US is entitled to a free credit report from all three major credit bureaus, and they can often be revealing, especially if you've had to deal with identity theft in the past. Get your report, then set an alert on your calendar from a year out from the day you get it—that's when you'll be eligible for a new one, and your calendar will tell you when to go get it again.

The beauty of all of this is that just about everything here is free, and lasts as long as you're willing to pay attention. You don't have to get your data stolen and wait for some company to make amends before you can take an active role in monitoring and protecting your credit. Best of all, once those companies sweep their lax security under the rug and their offers expire, you won't be stuck without a shield to protect yourself—and your finances—from identity theft.

Comments

Post a Comment